Business review

CHIEF EXECUTIVE‘S REPORT

INTRODUCTION

In the 2014/15 financial year, Clover reported record the earnings of its 118-year history. Although we are very proud of that performance, it set an exceptional benchmark against which we had to achieve this year. I am therefore all the more pleased to report continued strong growth across most performance measures.

Headline earnings per share increased by 8,9% or 15,3 cents to 188,9 cents per share, whilst earnings per share was down 2,4% to 185,9 cents (2015: 190,4 cents). A complete overview of Clover's financial performance is available in the Chief Financial Officer's report here of this Integrated Annual Report.

My overview will elaborate on how the business successfully mitigated a range of challenges and successfully created stakeholder value through leveraging opportunities. This report should be read in conjunction with the Chairman's report as well as the Chief Financial Officer's report for a holistic view of the Company and its performance during the year under review.

Financial strategy

We came to market in 2010 with the objective of diversifying our business away from bulk, commoditised dairy products, into higher margin, value added branded foods and beverages. Although our roots will always remain firmly in dairy, our quest to achieve above average operating margins through a portfolio not exposed to dairy price fluctuations continued to gain traction. Our efforts were significantly bolstered by the strong performance in the beverages portfolio in particular, and the fermented products categories in general.

Management's short-term focus remains to achieve an equal margin contribution from non-dairy and new value-add products on the one hand, and traditional dairy products on the other.

As illustrated in the graph below, the contribution to overall margin on material (MOM) of non-alcoholic beverages, fermented products and desserts, and other value-add products, increased from 35% in the 2014/15 financial year to 40% in the year under review.

Focus on cost reduction

The oversupply of raw milk in the earlier part of the reporting year, followed by the impact of a severe and protracted drought across most of the country in the latter part, accompanied by currency weakness and low economic growth, resulted in selling price stagnation and above inflationary cost pressures.

As a result, we focused on cost saving drives during the review period, with the management team driving efficiencies and cost savings exceptionally hard, with a specific on containing variable costs.

Selling and distribution costs were reduced by 2,6% or R52,1 million through re-negotiating contracts, especially on the delivery fleet.

We spent R30,6 million or 13% less on advertising, marketing, research and development costs compared to the prior year, by leveraging synergies through a “mother brand” approach.

Administrative expenses were consequently reduced by 2,8% or R8,5 million.

Head office incurred zero inflationary salary increases and expenses were reduced by 7,4% through:

- A freeze on filling vacant positions, especially at executive level

- A moratorium on legal and consulting fees

- The cancellation of conferences and special events.

Skills Development Levy grants received further offset the amount spent on training, compared to the prior year period.

Although the integration of certain manufacturing facilities created cost savings through synergies, a once-off retrenchment cost of R8,5 million was incurred, accounted for as restructuring expenses. (Refer to Human Capital, later in my report for more on the restructuring).

In the current financial year, Clover's senior management has committed to a salary freeze with no increases in order to contain costs further.

Curtailing capex

As reported on at the interim results, the completion of Cielo Blu marked a step change in Clover's approach from being expansion orientated to focusing on fully utilising its capacities and asset base. The remaining challenge is that Clover has several dispersed concentrated factories which are currently not being optimally utilised. Clover's butter factory is 280km from its main powder facility which produces most of the cream for butter production, and similarly its whey powder tower is 290km from its cheese factory that produces all Clover's liquid whey. There are currently two milk powder factories, one butter factory, one cheese factory and one whey powder factory, all in different towns, and this is not optimal for efficient functioning of our dairy supply chain.

The only exception is the Bloemfontein yoghurt capacity expansion which is due for completion in July 2018.

With our IT collaboration project with IBM (see Intellectual Capital below) and the Clayville chilled distribution expansion completed during the year under review, Clover's asset base is now substantially rejuvenated. Going forward, new capex investments will only be considered if there is a demonstrable, exceptional return on investment and a clear fit or bolt-on opportunity to the existing infrastructure.

Positive cash flow

A solid operational performance, supported by our cost savings drive and reduced capital expenditure, impacted favourably on Clover's cash flow, resulting in a positive cash flow position reported for the year under review, as highlighted below:

| 2016 | 2015 | 2014 | |

|---|---|---|---|

| CIL Group | R'000 | R'000 | R'000 |

| Cash generated from operations activities | 673 448 | 160 185 | 403 067 |

| Cash used in investing activities | (332 629) | (556 822) | (351,734) |

| Cash (outflow)/flow from financing activities | (212 426) | 218 097 | (97 780) |

| Net increase/(decrease) in cash and cash equivalents | 128 393 | (178 540) | (46 447) |

Return on Equity (ROE)

Return on Equity is a paramount performance measure for a number of capital market investors. Throughout the year we engaged with these shareholders to integrate greater focus on this measure into the long-term incentives for especially senior management. (Refer to the Report on Remuneration, and especially the letter to shareholders here of this Integrated Annual Report.)

Given a stagnant selling price environment and above in-flationary increases in variable costs during the reporting year, it is no surprise that return on equity excluding exceptional items decreased from the high base of 13,5% set in the prior reporting period, to 13,3%. Rising interest rates therefore impacted negatively on the ROE.

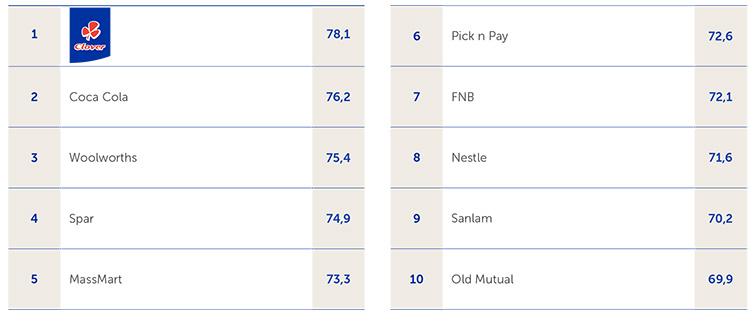

South Africa - 2016 Top 10

GOVERNANCE

I am particularly encouraged by Clover claiming the top spot in the 2016 South Africa RepTrak® study award for the most reputable company in South Africa, following the addition of the leading branded food and beverage company industry category this year.

Clover placed first in Governance and Citizenship, second in Products and Services, Workplace, Leadership and Performance and third in Innovation.

We pride ourselves on being a mature organisation, applying global best practice through an Enterprise Wide Risk Management Framework. The Board and management views corporate governance as paramount to sustainability and our risk policy and framework incorporate guidelines by The Committee of Sponsoring Organisations (COSO).

More information on how we manage, monitor and measure compliance through the internal audit function (outsourced to Deloitte), and our Ethics Hotline and Clover's Competition Law Centre of Excellence, is available in the Report on Governance, Risk and Compliance here of this Integrated Annual Report.

HUMAN CAPITAL

The Reptrak study mentioned above makes reference to Clover's ranking as “an ideal company to work for.”

This accolade is supported by our exceptionally low staff turnover and high-performance culture. As a management team we go to great lengths to ensure staff across all levels in the organisation is well-informed of our objectives and the strategies to achieve this.

Establishing a “creative tension” drives our strategy and “Way Better” philosophy, retaining key skills within the business, such as with the City Deep facility integration into Clayville, where most staff were redeployed in the business.

The Board subscribes to and supports Government's equity objectives and broad-based black economic empowerment. To this end we work closely with the Jobs Fund to unlock opportunities, such as our Masakhane project, that has already created a significant number of permanent employment opportunities and is set to create hundreds more.

Launched in 2012, the Clover Masakhane initiative is Clover's channel of entry into emerging markets and less formal trading outlets such as spazas, tuck shops, corner cafés, bottle stores, shacks and shebeens.

This channel is growing vigorously into a game changer for the emerging market, bringing many new entrepreneurs and employees into the mainstream market, while also creating demand for Clover's quality and nutritious brands in areas where these were previously unavailable.

Clover trains emerging entrepreneurs in retail skills and supply chain management so that their businesses can grow and become sustainable. Masakhane is proving to be such a win-win situation that Clover has received positive feedback for the Masakhane project.

More information on Masakhane and other Human Capital initiatives can be found here in this Integrated Annual Report respectively.

NATURAL CAPITAL

In 2015 South Africa produced a record three million tons of raw milk, followed by a sharp fall in raw milk supply through the first half of 2016 due to the severe drought and regular seasonal variations. The depressed prices for raw milk in 2015 rose considerably in the first half of 2016.

The high raw milk flow necessitated a reduction in farm gate milk prices which came into effect in August 2015 as the national milk intake was still 7,2% higher than the previous year. The impact of the drought towards the third quarter of the year under review was most notable in Kwa Zulu-Natal and the Highveld. Coupled with increasing feed cost as a result of a weak rand, farm gate milk prices were increased substantially above the levels at the time of overproduction in order to protect the primary industry.

Clover's proprietary Unique Milk Procurement System (“CUMPS”) matches milk procurement to market demand through quotas and contracted delivery agreements. Our raw milk source remains secure in the face of all foreseeable eventualities and we anticipate that the improved weather conditions forecasted for late 2016 and 2017 will normalise milk production.

The aim of CUMPS is to protect the primary industry in South Africa as dairy producers have greater see-through on potential milk offtake. The irony is that South Africa produces some of the highest quality milk internationally. Production capacity is not the challenge – finding a sustainable offset point for this production capacity is, but I will elaborate more on that under Manufactured Capital below.

The sustainability of Natural Capital is recognised throughout our value chain, including our carbon footprint, electricity consumption and wastage. Readers should refer to the chapter on Natural Capital here in this Integrated Annual Report for more information.

MANUFACTURED CAPITAL

Following our highly successful “Cielo Blu” project, which optimised Clover's distribution network and delivered over R100 million per annum in supply chain savings, management took a long a hard look at Clover's production facilities. Due to historic factors, some of these plants are geographically far apart and incur inefficient transport expenses from moving products and ingredients between them.

Over the past two financial years Clover has invested heavily in our production infrastructure and will significantly cut back on expenditure in this area for at least the next financial year. We integrated Dairybelle's and Nkunzi MilkyWay production facilities into Clover's manufactured capital, as well as installing two new production lines to meet a surge in demand for our incoming yogurt and custard brands.

We are optimising where we economically can, but a longer term solution is to centralise all our major production facilities into a strategically located and purpose-built industrial park strategically located near supply sources, other production facilities and major transportation routes.

This purpose built industrial park will offer substantial cost efficiencies by producing many of the ingredients and concentrates required for Clover products. By producing longer life powders, this industrial park would be purposefully designed for exporting local dairy products.

This is a medium to long term project due to the large capital investment required, therefore management is considering the business case for the park in conjunction with various stakeholders and government.

I am equally excited about Clover Masakhane, as I elaborated on under “Human Capital” above. This project is a catalyst for growth in a previously untapped market segment. The nuts and bolts are discussed further under Manufactured Capital here.

INTELLECTUAL CAPITAL

The hyper competitive retail industry is moving towards planning its product selection and stocking levels through an average daily rate of sale, whereby future customer orders will be calculated by a statistical algorithm and the retailers themselves take hands-on control of their demand and in-store planning.

Clover's leadership decided on an aggressive approach to evaluating and adopting technologies that will future-proof Clover. To this end we have partnered with IBM to develop a proprietary business intelligence system to support management decision-making at all levels. This “Kolabo” project will enable managers to use “big data” analysis for insights into market dynamics, trends in consumer consumption and the needs of our clients.

But these technological advances are not without risk, and could threaten Clover's distribution revenues if we don't react promptly: As Pick ‘n Pay in the Western Cape is presently updating its ordering systems, Clover has temporarily halted distributing certain products for its stores.

Clover and one of the prominent retailers are collaborating closely on an enhanced distribution system based on the aforementioned evolution towards algorithms, which will provide important lessons for the remainder of our distribution network.

The largest component of Intellectual Capital is our brands, the performance of which is outline below. All the market share and market growth statistics discussed below are based on the independent “Nielsen Total Trade Desk” data (“Nielsen data”), which comprises Shoprite Checkers, Pick n Pay, Woolworths, Spar group and Fruit and Veg City data and is consistent with the measures applied in prior reporting years. We also compare the “Nielsen data” to our internal volumes as the Nielsen data is based on the top-end, and does not necessarily include data that relates to the bottom of the pyramid.

The hyper competitive retail industry is moving towards planning its product selection and stocking levels through an average daily rate of sale, whereby future customer orders will be calculated by a statistical algorithm and the retailers themselves take hands-on control of their demand and in-store planning.

Clover's leadership decided on an aggressive approach to evaluating and adopting technologies that will future-proof Clover. To this end we have partnered with IBM to develop a proprietary business intelligence system to support management decision-making at all levels. This “Kolabo” project will enable managers to use “big data” analysis for insights into market dynamics, trends in consumer consumption and the needs of our clients.

But these technological advances are not without risk, and could threaten Clover's distribution revenues if we don't react promptly: As Pick ‘n Pay in the Western Cape is presently updating its ordering systems, Clover has temporarily halted distributing certain products for its stores.

Clover and one of the prominent retailers are collaborating closely on an enhanced distribution system based on the aforementioned evolution towards algorithms, which will provide important lessons for the remainder of our distribution network.

The largest component of Intellectual Capital is our brands, the performance of which is outline below. All the market share and market growth statistics discussed below are based on the independent “Nielsen Total Trade Desk” data (“Nielsen data”), which comprises Shoprite Checkers, Pick n Pay, Woolworths, Spar group and Fruit and Veg City data and is consistent with the measures applied in prior reporting years. We also compare the “Nielsen data” to our internal volumes as the Nielsen data is based on the top-end, and does not necessarily include data that relates to the bottom of the pyramid.

Fresh and ultra-pasteurised milk

Clover's volume only increased 2,3% against the prior year, mainly as a result of the low market prices for UHT. The total market for fresh milk contracted by 2% against the comparative year also reflecting the low prices for UHT. Clover's market share for the year reduced from 27,9% to 24,1%.

UHT milk

Continued aggressive pricing by retailer house brands resulted in overall total market volume growth of 9,9%, albeit slower than the 19% market growth recorded in the industry. The surplus experienced in the last quarter of the prior financial year curtailed Clover's ability to retain market share during that year. During the current year, Clover's UHT volumes in the Nielsen channels also contracted as a result of Clover's increased involvement in Dealer Owned Brands, Clover's market share contracted from 16,4% to 14,4 % for the year.

Cream

Total market volume growth contracted 2,4 % for the year under review. Clover's market share however decreased by 8,9% to 28,8%, largely as a result of less cream available to sell due to the lower fresh milk sales during the year.

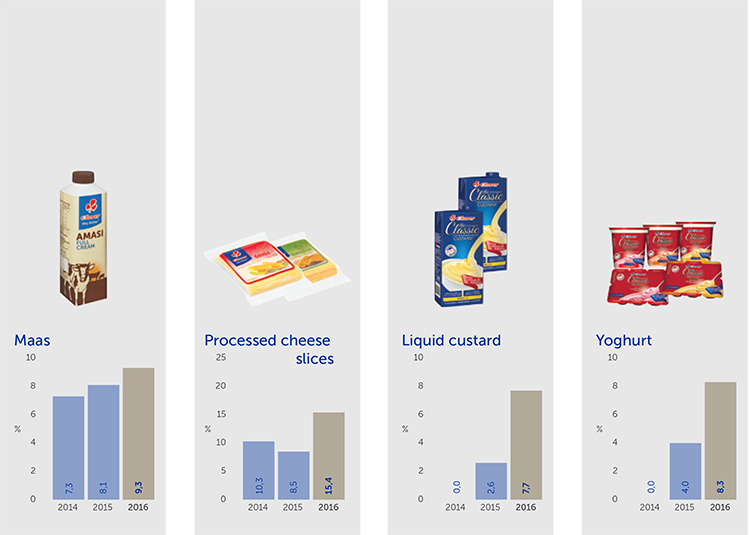

Maas

Clover's volumes grew by 34,2% and we continued making inroads into this segment by growing market shares from 7,3% to 9,3%.

Feta cheese

Clover grew its market share by 7,1% to 28% on the back of a 9,3% volume growth in Clover.

Pure juices

Overall volumes in the pure fruit juice market continued to decrease, reflective of reduced discretionary consumer spend. Despite a contraction in the overall market, Clover's volumes increased by 4,14%, although its market share in the top end contracted by 6,9% to 42,9%.

Iced-tea – ready to drink

The ice tea category continued its growth, and Clover's volumes increased by 11,1%. Clover's market share in this competitive category also increased by 1,7% to 17,5%.

Dairy fruit mix

Clover maintained its market share at 79,3% through its popular “Tropika” and “Danao” brands at 79,3%. Given a strong performance at the bottom-end, however, Clover managed to achieve 5,9% volume growth in this category.

Bottled water

The total market volume in this segment increased by 21,8% during the year under review although Clover Waters' market share in this segment declined by 16% to 10,9% from 13%, mainly as a result of strong competition.

Pre-packed cheese

The overall volumes for natural pre-packed cheese grew by 18,0% during the year under review. Clover's market share in this category grew 24,8% to 23,8% due to more competitive pricing.

Flavoured milk

Clover's “Super M” brand increased its volumes by 8,7%, although its market share contracted by 3,5 % to 25,6%.

Yogurt

Clover entered the yoghurt category in January 2015 by introducing its own range of yoghurts under “The Classic” brand, in addition to the manufacturing and distribution of the acquired and relaunched “Fruits of the Forest” brand.

The total market volume grew by 136,6 % during the year under review. Clover's market share for the whole year (although only participating in this category for half of the year) came to 8,3%. The market share at June 2015 was 4%.

This marked improvement, was done to manufacturing capacity in Bloemfontein being increased.

Custard

Similar to yoghurt, Clover only entered the custard market in January 2015. Volumes in this market category grew 199% and Clover's share of this market's annual sales volumes was 7,7% compared to 2,6% previously. Clovers total volumes grew 133% in this category.

Butter

Total market volumes contracted by 5,1% as a result of low inventory levels and the availability of cream.

Carbonated drinks (Frankies), Soya and nut-based drinks (Good Hope), Smart drinks (Futurelife)

All of the above had no base year, and volumes and market share therefore grew 100%.

SOCIAL AND RELATIONSHIP CAPITAL

I am proud of all the awards that Clover has won over the past year, which shows that we are doing much that is right and good. In particular, winning the 2016 South Africa RepTrak® study award as the most reputable company in South Africa was an eye-opening accolade, especially as we placed ahead of legendary brands such as Coca-Cola and Woolworths.

The Clover Mama Afrika project launched in 2004 is close to my heart, being such a practical and authentic means of channelling self-empowerment, skills development and dignity into marginalised communities. This worthy undertaking was again recognised by winning PMR's prestigious Diamond Arrow Award.

I underwent my own somewhat unexpected awards adventure by being selected as Southern Africa's EY Entrepreneur of the Year, which meant going to Monaco in June 2016 to face off against the EY regional winners from around the globe.

After a fascinating week of interacting with great international achievers – not all from the world of business – and rubbing shoulders with truly special entrepreneurs, we all had to face up to the fact that we had again lost to an Australian. Manny Stul was a worthy winner with a stirring story to tell of struggling to succeed against exceptionally unkind events – and he did. I was inspired and humbled, while learning much to bring home.

Outlook

Much of the world – including South Africa – has entered into such a precarious era that attempting to make any kind of prediction can be foolhardy.

Nevertheless, I will err on the side of optimism by predicting that South Africa's weather and milk production will normalise through the summer of 2016/17. Current indications are that the strong El Niño effect over the Pacific Ocean that is blamed for Africa's drought has dissipated and is being replaced by weak La Niña, which is likely to bring heavier than average rains to southern Africa from November 2016 onwards.

In this scenario, food and beverage input costs should fall and bring down food price inflation. South Africa and its population should benefit from a multimillion rand turnaround in the agricultural sector that will ease balance of payment pressures from food imports and hopefully lower prices for producers and consumers alike.

VALUE CREATION

In addition to innovative projects such as Masakhane, Clover will continue to expand its operations within the BNLS (Botswana, Namibia, Lesotho and Swaziland) region and will pursue further export opportunities on the continent where risks can be mitigated.

Our focus will remain on fully utilising capacities and the asset base we built over the past five years, and we will explore local consolidation opportunities where synergies can be leveraged.

APPRECIATION

I would like to thank the Board, especially Mr Werner Büchner, for its continued support and guidance during a challenging 12 months. Mr Tom Wixley has been the lead independent director on our Board since listing in 2010. Tom decided not to stand for re-election and I wish him well in his retirement. Thank you for your sage advice and input over the past six years.

Our relationship with our producers remain a beachhead for our sustainability and once again I thank them for their continued support and interaction. Mr Peter Griffin, a producer shareholder, has decided to retire from the Board and won't be offering himself for re-election. I would like to thank Peter for his valuable guidance and look forward to engaging with him in future, especially as a representative voice for some of our producer stakeholders. The Board has decided not to appoint any new directors to replace Mr Wixley and Mr Griffin at this point in time.

In particular I want to thank each staff member and their families for their devotion and hard work during a challenging year – your “Way Better” approach to challenges has carried us through.

Lastly, a final word goes to my executive team for their hard work and commitment. It is with a heavy heart that I say farewell on a professional level to Mr Jacques Botha and Dr Chris Lerm, who both retired from the Board during the year. Your contribution to our success as a company and a team was tremendous and something I personally cherish.

The strategy has always been to maintain a focused executive team, and our succession planning processes began many years ago as we knew some of the executives were due to retire. The appointment of Mr Elton Bosch, Mr Marcelo Palmeiro and Mr Jacques van Heerden to the executive team was part of succession planning, making them an integral part of the functioning of the Executive Committee assisted with adequate knowledge transfer. Together with their core skills sets, this enabled us to have a seamless transition in replacing Mr Jacques Botha, Dr Chris Lerm and Mr Manie Roode over the past three years. As a result, the Executive Committee has now been reduced from eight members to six members, which will assist us in curtailing costs further.

I welcome Mr Elton Bosch to the position of Financial Director and look forward to his continued contribution and insights as part of the Board.

Johann Vorster

Chief Executive

12 September 2016

All market shares shown here are based on data received from Nielsen. Please note some market shares for 2015 have been restated due to changes made in the Nielsen database.