Governance, risk and compliance, and remuneration reports

remuneration mix

The remuneration structure comprises three components and is aligned with achieving Clover’s objectives:

Remuneration mix: Guaranteed Fixed Income component

GUARANTEED FIXED INCOME PROVIDES:

- monthly salary

- compulsory benefits (i.e. retirement)

- discretionary benefits (i.e. medical aid).

Employees on the Paterson Grade C3 and lower can choose to join the Discovery Health Medical Scheme or Umvuzo Medical Scheme. For these employees, membership to a medical scheme is not compulsory. For Paterson Grade C4 and higher, the Discovery Health Medical Scheme is compulsory.

GUARANTEED FIXED INCOME COSIDERATIONS:

- Regular benchmarking exercises are performed internally and externally to ensure equity, fairness and market relatedness

- The fixed income component is reviewed annually in May and is revised on 1 July of each year, following quarterly performance management reviews of each employee

- Interim reviews of the fixed income component are undertaken to retain talent, taking into account market adjustments or employee promotions

- Clover’s employment profile is based on the competencies, outputs and behaviour required for a specific position

- The employment profile must fit within the organisational structure and an appropriate employment grade should be assigned to the position.

SCARCE SKILLS

Scarce skills are those of which market demand outstrips the available supply. Scarce skill sets are identified annually and the strategy is adjusted to reduce business risk. If scarcity results from a unique combination of skills and experience being required, Clover will attempt to reduce business risks by building talent pools around incumbents with these scarce skill profiles.

Scarce skills incumbents are graded as ”S”-band employees in Clover’s employment scale.

To reduce the risk of losing highly specialised skills, the fixed income component applied to this category is targeted at the top-end (90th percentile) of the market range and also includes a discretionary retention bonus (8% of annual basic salary) payable at the end of each financial year, provided that the necessary performance criteria are met. Clover has presently qualified 18 for ”S”-band status. The Executive Committee annually reviews the ”S” band category and its incumbents.

DIFFERENTIATION BETWEEN PATERSON GRADES:

Remuneration mix: Annual Short-Term Incentive component

ANNUAL SHORT-TERM INCENTIVE SCHEME (STI)

STIs ARE DESIGNED TO DRIVE ANNUAL IMPROVEMENT OF CLOVER'S RESULTS.

| Paterson Band | Individual performance % |

Group profit % |

Individual performance cap % |

Group profit cap % |

Entitlement (months base salary**) |

Max entitlement (months base salary**) |

Profit target |

| C5 | 66,7 | 33,3 | 100 | 200 | 2 | 2 | Operating profit |

| D1 – D2 | 50 | 50 | 100 | 150 | 2 | 2,5 | Operating profit |

| D3 – D5 | 33,3 | 66,7 | 100 | 175 | 3 | 4,5 | Operating profit |

| E* | 30 | 70 | 100 | 171 | 5 | 7,5 | Operating profit |

| Other Executives***(F) | 30 | 70 | 100 | 171 | 10 | 15 | Normalised attributable profit |

| Chief Financial Officer(F) | 30 | 70 | 100 | 171 | 10 | 15 | Normalised attributable profit |

| Chief Execuitve(F) | 30 | 70 | 100 | 171 | 12 | 18 | Normalised attributable profit |

| * For example, if a staff member on the Paterson E band achieves a 100% individual performance bonus and a 171% Group profit bonus the employee will be able to earn 7,5 months' additional base salary in bonuses. ** For Paterson Grades D1 to D5 the base salary consists of the employees' monthly basic salary, for Paterson Grades E, the base salary consists of the employees' monthly basic salary, plus 22% car allowance plus 10% pension fund contribution and for Paterson Grade F, the base salary consists of the employees' total monthly guaranteed fixed income. *** Marcelo Palmeiro and Jacques van Heerden's STI differ from what is stated above as it has been agreed to individually between them and the Company. |

|||||||

STI MEASURES AND TARGETS

For Paterson Grade C:

- Individuals who score an annual individual performance rating of 4 or 5 qualify for a merit bonus

- This merit bonus is calculated as a percentage of annual basic salary and is paid in August or September of each year.

For Paterson Grade E and D:

- The individual performance portion of the STI is based on specific key performance indicators agreed to between the employee and his/her direct manager it is calculated on operating profit before restructuring costs

- The profit target is triggered once 100% of target is reached

- An additional 1% is added to the bonus for every 1% achieved over the profit target.

For Paterson Grade F (executive):

- The individual performance portion of the STI is based on specific key performance indicators approved annually by the Remuneration Committee and includes, inter alia

- leadership and team building

- optimising the brand portfolio

- increase market shares through sales and distribution achievements

- successful completion of capital projects

- mergers, acquisitions and rest of Africa

- employment equity

- investor relations.

- calculated using normalised attributable profit

- the profit target is triggered once 100% of the profit target is reached. If the profit exceeds the target, an additional bonus of 3,55% for the CE and 3,55% for the CFO and other executives will be paid for every 1% achieved over the profit target.

STIs are self-funded since all bonuses are budgeted for in full before the profit target is approved annually by the Remuneration Committee. The final profit figure is confirmed by the Remuneration Committee and approved by the Board following completion of the annual audit. It is not necessarily linked to the budget approved by the Board. Incentives are paid in August and/or September of each applicable year. The Remuneration Committee has the sole and absolute discretion to make adjustments for extraordinary factors, taking into account external factors beyond the control of employees, such as cyclicality. Employees found guilty of gross misconduct will not be entitled to STI participation. Quarterly performance management sessions are scheduled with each employee to guide them to achieving profit targets and bonuses.

Remuneration mix: Long-Term Incentive component

LONG-TERM INCENTIVE SCHEME (LTI)

Clover's LTI is a deferred bonus scheme that serves as a retention mechanism. It awards employees on Paterson Grade E and certain positions on grade D5 for adding tangible value to Clover's business.

LTI MEASURES AND TARGETS ARE:

- calculated using normalised attributable profit

- a percentage of annual base salary

- paid out in equal amounts over a three-year period (with the first tranche paid out 12 months after becoming entitled).

| Target achieved | Bonus payable |

|---|---|

| Normalised attributable profit target as per budget | 20% of annual base salary |

| Normalised attributable profit target as per budget plus 10% | 40% of annual base salary |

| Normalised attributable profit target as per budget plus 20% | 60% of annual base salary |

SHARE APPRECIATION RIGHTS SCHEME (SAR Scheme) OR (SARs)

The purpose of the SAR Scheme is to attract, retain, motivate and reward Clover's executives (Paterson Grade F) and other participants able to significantly influence Clover's performance by aligning their interests to those of the shareholders. The SAR Scheme is governed according to rules approved by Clover's shareholders in November 2010 (as amended from time to time).

SARs MEASURES AND TARGETS

The eligibility criteria, the quantum of allocations and the conditions governing each allocation are determined by the Remuneration Committee. This assessment takes into account seniority within Clover, work function and the participant's ability to add value to Clover.

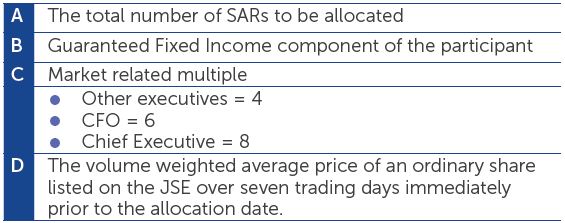

FIRST TIME ALLOCATION OF SARs

The market-related formula that follows is used to determine the number of share appreciation rights a participant may gain when participating in SARs for the first time:

A = (B x C)/D

Where:

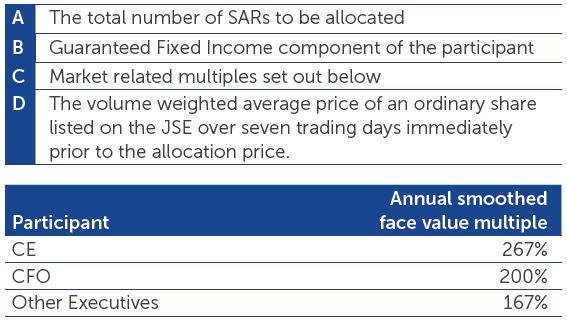

SUBSEQUENT SARs ALLOCATIONS (FOLLOWING A PARTICIPANT'S FIRST ALLOCATION)

Following a PWC conducted benchmarking exercise, the Remuneration Committee resolved with effect from 1 July 2012 (the fourth allocation) that the following smoothed average face value allocation formula will be used when allocating SARs to a participant who has already earned a first allocation:

A = (B x C)/D

Where:

CHANGE OF CONTROL PROVISIONS

Prior to 1 January 2014, if Clover is the subject of any transaction whereby any person or persons acting in concert, other than the Clover Milk Producers Trust and/or participants, acquire (whether directly or indirectly) 30% of the entire ordinary issued share capital in Clover, then all SARs held by participants shall immediately vest. All SARs shall (whether or not the vesting dates in respect thereof have passed and/or the performance criteria, if any, in respect thereof have been met) be exercisable on the basis that participants shall be settled in accordance with the SARs Plan.

In respect of any SARs allocated to participants on or after 1 January 2014, if 30% of the entire issued share capital of Clover is acquired by any person or persons acting in concert (other than the Clover Milk Producers Trust and/ or the participants), not all of the SARs shall immediately vest in participants but only the proportionate number thereof, having regards to (i) the period of time that has lapsed between the allocation date and the vesting date at the time of the acquisition (whether directly or indirectly) and (ii) the extent to which the performance criteria (if any) have been satisfied as at the date of the acquisition, as may be determined by the Remuneration Committee to be fair and reasonable to the participants concerned. Should a dispute arise between the participants and the Remuneration Committee such dispute shall be referred to the Board for determination, provided that should such dispute not be resolved within a period of 60 (sixty) days from such referral to the Board the dispute shall be referred to the expert in terms of section 15 of the SARs Plan for final determination.

PERIOD OF VESTING OF SARs AND PERFORMANCE CRITERIA

The SAR Scheme rules provide that all SARs allocated on or after 30 June 2016:

- will vest in full after the third anniversary of the allocation date, provided that the relevant performance criteria were met

- SARs that are vested already must be exercised by the participant on or before the fifth anniversary of the allocation of these SARs.

SARs PERFORMANCE CRITERIA

For information relating to the performance criteria that will apply to SARs allocated prior to 30 June 2016, please see here in Clover's 2016 Annual Integrated Report.

All SARs allocated on or after 30 June 2016 will be subject to the following performance criteria:

Individual performance condition

30% of the allocation to be subject to the achievement of individual performance, measured as the average over three years. 30% vests at 70% performance and 100% vests at 90% performance as follows:

| Performance | Weighting | Targets |

|---|---|---|

| Individual performance condition |

30% | Average individual performance measured over 3 years 30% vests at 70% performance 100% vests at 90% performance. |

Financial performance conditions

70% of the SARs allocation will be subject to financial performance:

- headline earnings per share constituting 35%

- ROE constituting 35%.

The HEPS performance condition targets will be as follows:

| Performance | Weighting | Targets |

|---|---|---|

| Financial performance condition HEPS |

35% | Threshold: 30% will vest if HEPS growth (over the performance period of 3 years) of CPI +4% per annum is achieved Target: 65% will vest if HEPS growth (over the performance of 3 years) of CPI +6% per annum is achieved Stretch: 100% will vest if HEPS growth (over the performance period of 3 years) of CPI +8% per annum is achieved. |

In line with other conditions of performance, three ROE targets will be set:

- The threshold target, where 30% (of the remaining 20%) of the SARs allocation will vest

- The target, at which 65% (of the remaining 20%) of the SARs allocation will vest

- The stretch target, at which 100% (of the remaining 20%) of the SARs allocation will vest.

The ROE targets will be as follows:

| Performance | Weighting | Targets |

|---|---|---|

| Financial performance condition ROE |

35% | Threshold: 30% will vest if actual ROE achieved in the base year* Target: 65% will vest if actual ROE achieved in the base year* + 0,4% Stretch: 100% will vest if actual ROE achieved in the base year* + 0,9%. |

| * Base year = year in which allocation is made. ** Base year – will be calculated by taking the actual ROE, excluding exceptional items, as at 30 June 2015 (13,5%) and applying a 0,3% annual incremental increase. |

||